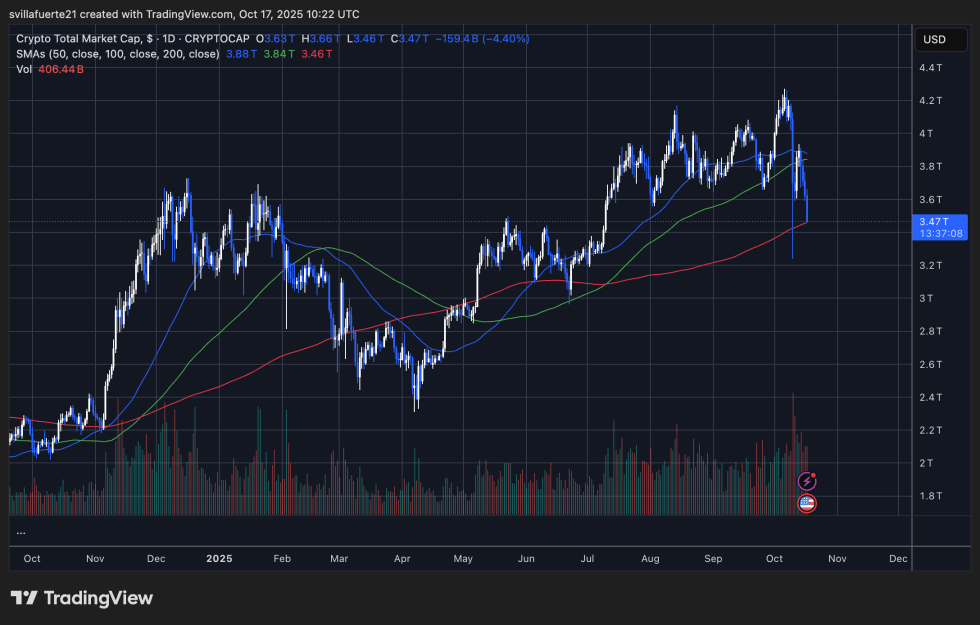

The BTC price slid under $105,000 on Friday, tagging a 15-week low and revisiting supports first probed during last week’s tariff-sparked selloff.

Short-term momentum has weakened after repeated failures to hold above $112,000–$116,000, leaving price compressed between a $104,000–$107,000 demand zone and heavy resistance near $120,000–$124,000 (the prior ATH band).

Technicians note that BTC price has now interacted with its 200-day moving average for the first time in six months, while the 20- and 50-day MAs trend lower, typical of a cooling phase after a vertical rally.

BTC Price Tests $104K–$107K Support as Leverage Clears

Despite the headline drop, Bitcoin’s derivatives data and positioning point to a “controlled deleveraging” rather than panic. Open interest has reset to mid-year levels and funding flipped negative during the flush, indicating speculative longs were forced out.

Spot flows remain steadier by comparison, suggesting long-term holders are largely unmoved.

If bulls reclaim $110,000–$113,000, a relief bounce toward $116,000–$120,000 is plausible; lose $104,000–$106,000, and many traders eye the $101,000–$102,000 “wick fill,” with some warning a swift tag of $98,000–$100,000 if liquidity thins.

Macro Cross-Currents: Banks, Gold, and the Fed

Macro stress amplified the move. Renewed pressure on U.S. regional banks, echoing the 2023 episode, fed risk-off flows just as U.S.–China trade tensions re-flared.

Meanwhile, gold printed fresh highs, highlighting a safe-haven bid while crypto cooled. Market odds favor a potential Fed rate cut at the late-October and early-November meeting, which could ease financial conditions and support a Q4 crypto rebound; a hawkish surprise, however, would likely extend consolidation.

Bitcoin ETF flows have moderated from a record pace, with select U.S. crypto funds posting net outflows this week as investors de-risk.

Nonetheless, the broader investment case, ETF access, institutional adoption, and a structurally constrained BTC supply, remain intact, according to several desks framing the slide as a healthy reset after “Uptober’s” exuberance.

Altcoins Underperform While Bitcoin Dominance Rises

Altcoins extended losses as liquidity rotated into BTC and stablecoins. ETH, BNB, SOL, XRP dropped 7-12% on the day, while higher-beta names like DOGE and ADA fell more sharply week-to-date. Historically, this phase of rising BTC dominance persists until Bitcoin stabilizes and risk appetite returns downstream.

Key levels to watch include a BTC price Support $104,000–$106,000, then $101,000–$102,000; Resistance $110,000–$113,000, $116,000, and $120,000–$124,000.

A decisive close back above $120,000 would reassert the uptrend and put new highs back in focus. Until then, analysts expect rangebound, catalyst-driven BTC price action as leverage stays light and the market digests macro signals.

Cover image from ChatGPT, BTCUSD chart on Tradingview

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments